Learn more about securing your financial future.

Inflation, Interest Rates and Your Investments

Lately, we’ve all been seeing a few less dollars in our wallets. Between groceries, fuel and the cost of homes, things are surely getting more expensive. The word “inflation” is being tossed around, but what in fact is inflation and how does it affect interest rates...

Social Media Platforms – What You Need to Know

You’re a business owner and want to promote your business online - smart thinking! However, there are just so many social media platforms, how do you know which one is right for you and your business? There are indeed more than a few and they’re all slightly...

Resources to help preserve your memories!

In today’s digital world, all of life’s beautiful moments can be captured in abundance as photos, videos and messages stored locally on your phone or computer or posted up in the “cloud” to share the joy broadly on social media at the touch of a button. Have you...

Building Connections Through Direct Response Marketing… More than just Social Media

Are you a business owner? Are you wondering how to promote your business and build fruitful connections on social media? Today, it’s no longer about those old, templated letters or cold calls to customers because social media has changed the way we promote and do...

Corporate Owned Life Insurance – Watch Those Beneficiary Designations!

As a business owner, your corporation has a life insurance policy on your life - a key part of your estate and succession planning! However, to avoid unintended tax consequences, it’s critical that the beneficiary designations of your corporate-owned life insurance...

Is an Estate Freeze Something I Should Consider for my business?

You own your own business and recently, you’ve heard some talk about estate freezes. So, what exactly is an estate freeze and should you consider implementing one? There are several things that should be considered but let’s start with what an estate freeze is....

How Much Should I Contribute to My RRSP?

January 12, 2022 Author: The Link Between Figuring out how much to contribute to your RRSP is important. Do it right, and you maximize your tax savings now, while setting yourself up for a good income after retirement. Do it wrong, and you could find yourself paying...

The Ultimate Planning Tool

The Ultimate Planning Tool: For prioritizing what you want when you want January 5, 2022 Author: The Link Between Permanent life insurance is often said to be the ultimate planning tool because it facilitates beneficial tax and estate planning opportunities and...

It’s Beginning to Look a Lot Like Tax Season

Everywhere you go Take a look at your T5 and T4, or you may soon be poor With all the taxes at your door. It’s that lovely time of the year when everyone is full of cheer (the 2021 brand of cheer, that is!) And now, tax season is just around the corner. But that’s no...

The Best of Both Worlds: Segregated Funds in a volatile market

If you’re an investor, you know all too well that 2020 was a volatile year for investment portfolios – not to mention life in general. And while we hope that the worst is behind us, history tells us that market volatility is nothing new. Who remembers the Y2K tech...

Love and Money

Ah love… it’s a beautiful thing, but sometimes finances and money worries can get in the way. In fact, 84% of respondents in a Money Magazine survey said that money was the source of marital tensions with disagreements about financial priorities topping the list of...

Shining a Light on Seasonal Affective Disorder

Did you know that nearly 10 percent of Canadians ages 12+ are affected by a mood disorder (1)? A mood disorder refers to a general emotional state or mood that interferes with one’s ability to function - major depression disorder (MDD), anxiety and bipolar disorder...

Getting the Most from Your RESP

Interested in maximizing the impact of your RESP contributions? Here is a great strategy to consider. First, a bit of a refresher on RESPs: the Registered Education Savings Plan has two significant benefits. First, the availability of government grants. The government...

Making Your Retirement Easy Breezy with RRIFs and LIFs

If you’re nearing your retirement years, you know that the prospect of retirement can be both very exciting and a wee bit anxiety-inducing. Exciting because you finally get to sleep in late, spend more time with your grandkids, volunteer and finally travel…when the...

Changing Gears – From Accumulation to Decumulation

You’ve been diligently stashing away some money from every paycheque, contributing to your RRSP and/or TFSA. Perhaps you have a defined contribution pension or, if you’re one of the lucky ones, the defined benefit version. Whatever your process, when it comes to...

Can the CRA Seize Life Insurance Proceeds to Satisfy Tax Debts?

The words Canada Revenue Agency have the tendency to make any of us a little nervous when it comes to debts owed and tax collection. More so since the Canada Revenue Agency (CRA) maintains certain powers under the Income Tax Act (also known as the “Act”) to collect...

Protecting Your Estate

You’ve worked hard throughout your lifetime and this hard work has finally paid off. Perhaps you’ve accumulated assets beyond even those that you may need to enjoy a carefree and relaxed retirement that will eventually be passed on to your heirs. However, some of...

Beneficiary Designations – Making Sure Your Money Goes Where You Want

We work hard all of our lives. This hard work allows us to afford a home, maybe splurge on a few vacations, save a few dollars and when we pass, transfer our wealth to those we love, whether they be immediate family or a specified individual(s). Normally, this...

Things to Consider When Renewing Your Term Insurance Plan

When it comes to choosing life insurance, term insurance offers several benefits including simplicity, predictability and affordability. Lower premiums in the early years allow you to maintain the same standard of living while providing you with crucial income...

What a Difference a Year Makes… Getting Your Employees the Best Care Today

Another spring has sprung and we are now one full year into the COVID-19 pandemic – a pandemic that none of us saw coming and that has gripped us like nothing we have experienced before. Whether it be working from home or maintaining the frontline as an essential...

The Family Divide: Policy Transfers Amongst Family

As life’s circumstances change, a family may one day want to transfer ownership of personally owned life insurance to another member of the family, such as a spouse or child. With an ownership change, the life insured remains the same, although the new owner may...

How your Life Insurance can Help your Favourite Charity

The gifting of life insurance to registered charities has always been a popular method for individuals to fulfill their philanthropic goals, and worth considering when it comes to a charity that is near and dear to your heart. There are basically two options when...

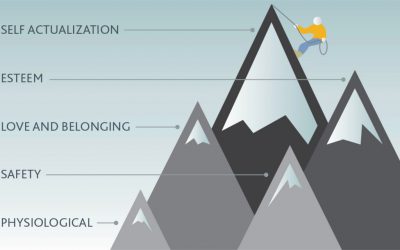

Planning for a Lifetime of Adventure

Life is an adventure full of twists and turns, and learning to navigate it can take a lifetime. Unfortunately, that’s a little too late. That’s why planning early for your financial future is so important. Where to begin though? Read our article about the hierarchy of...

What to Expect When you Apply for Insurance

Prepare for the future. Live in the moment. You hear this advice all the time and wonder which makes more sense. Well, the answer to that is easy – if you prepare for the future, it makes living in the moment a lot easier to do. Applying for life insurance is an...

Protecting Your Investments

So you’re thinking about retirement and have a few questions such as how much capital will you need for your retirement and how much do you need to save each month to meet that goal. All great questions, but don’t forget to ask this one critical question - are my...